Open enrollment can feel overwhelming, especially when you’re trying to figure out what your insurance actually covers for mental health care. The good news? With a bit of clarity and guidance, you can find a plan that supports both your emotional well-being and your financial peace of mind. Each year, open enrollment allows you to compare plans, adjust coverage, and choose the best fit for your needs. But with so many plan types, terms, and fine print, it can be difficult to know where to start.

If you’re seeking therapy or already seeing a provider, understanding what your insurance actually covers can make a big difference in cost and accessibility. The good news is that with a little guidance, you can approach this year’s open enrollment period with clarity and confidence. This guide will walk you through what open enrollment means, what’s changing for 2026, and how to evaluate health insurance plans, particularly when it comes to finding one that supports your mental well-being.

What is open enrollment?

Open enrollment is the annual window when you can enroll in, renew, or make changes to your health insurance plan. During this time, employees and individuals can compare different options and decide which level of coverage best fits their needs for the upcoming year. Outside of this period, most people can only make changes if they experience a qualifying life event such as getting married, having a baby, or losing previous coverage.

For many, this is the one time each year to ensure your health insurance plan reflects your current circumstances. Maybe you’ve started therapy and want a plan that offers better mental health benefits, or perhaps your family’s healthcare needs have shifted. Taking advantage of the open enrollment period helps you stay protected and avoid gaps in coverage.

When does open enrollment start?

The open enrollment period for 2026 is expected to begin on November 1, 2025, and end on December 15, 2025, according to the Health Insurance Marketplace guidelines. These dates apply only to insurance exchanges, which represent a relatively small portion of plans and a subset of Grow Therapy’s patient population. This six-week window applies to most states, though some state-run exchanges, like California or New York, may extend their deadlines slightly. Double-check the dates for your state’s marketplace so you don’t miss your chance to enroll or make updates.

If you receive coverage through your employer, your company’s open enrollment period might differ. Many employers hold their own enrollment window during the fall, often in October or November, so employees can select plans for the next calendar year. Regardless of where you get coverage, treating open enrollment as a firm deadline helps prevent lapses in care, especially if you’re managing ongoing mental health needs or seeing a therapist regularly.

Before enrollment begins, take time to review your current plan and note what’s working and what isn’t. Understanding your coverage will help you make a more informed choice when comparing new health insurance plans.

Is anything changing for open enrollment in 2026?

Each open enrollment period brings updates that can affect how you choose coverage. For 2026, early reports suggest modest adjustments to premiums and subsidies, alongside expanded access to telehealth and mental health services. Grow provider Raymond J.A. Stephens, LCSW shares his insight on preparing for this: “Due to the possibility that premiums may rise, money management and financial awareness is key.” In other words, budgeting for therapy and understanding your plan’s mental health benefits can help prevent interruptions in care.

According to Blue Shield of California’s 2026 open enrollment guide, many insurers are refining their plans to make behavioral health care more affordable and accessible, continuing trends that began under the Affordable Care Act.

These updates mean it’s more important than ever to review plan details carefully, rather than simply renewing your existing coverage. Even small policy changes like increased copays or new network partnerships can impact how much you’ll pay for therapy sessions or whether your preferred provider remains in-network.

New regulations and policies

While the Affordable Care Act (ACA) continues to provide the foundation for essential mental health coverage, policymakers have focused on strengthening parity laws, which require insurers to cover mental health and substance use treatment at the same level as medical care. In 2026, regulators are expected to tighten enforcement of parity laws, which require mental health and substance use benefits to be comparable though not necessarily identical to medical benefits. In other words, therapy sessions, medication management, and teletherapy should come with similar cost-sharing and visit availability as primary care.

The federal government has also proposed new reporting requirements to improve transparency around mental health coverage. This means insurance companies might soon have to clearly outline what mental health services their plans include, making it easier for employees to understand and compare coverage options.

Updates on insurance marketplaces

Marketplace insurers are also refining their offerings to better support telehealth and integrated behavioral health care. Many states are expanding access to virtual therapy platforms and increasing reimbursement rates for teletherapy, which can make it easier to see a therapist without commuting or taking time off work.

These shifts can benefit anyone looking for flexible, accessible care. When comparing marketplace options, confirm whether virtual therapy is fully covered, prepare for any potential out-of-pocket costs, and ensure your preferred platform is in-network.

Impact on premiums and subsidies

Premiums are expected to rise slightly across most health insurance plans in 2026, reflecting increased healthcare utilization and inflation. According to HealthInsurance.org, most enrollees who qualify for premium tax credits will still pay less than $100 per month for coverage.

For employees, your employer’s contribution can also help absorb premium increases, but don’t assume the cheapest plan offers the best overall value. Plans with lower monthly premiums often come with higher out-of-pocket costs, especially for therapy sessions. On the other hand, paying a bit more each month can mean lower deductibles and copays, which may save you money overall if you see a therapist regularly. Comparing deductibles, copays, and coinsurance is key to understanding your total financial responsibility.

How to choose the right plan for optimal therapy coverage

Let’s look beyond premiums. While price matters, it’s equally important to understand how coverage applies to therapy, medication, and other behavioral health needs. Getting curious during open enrollment can help you avoid surprise costs later and ensure continued access to the care you need.

Assess your healthcare needs

Think about how often you visit a doctor, whether you see specialists, and how frequently you go to therapy. If you’re already working with a therapist or planning to start, it’s worth considering plans that emphasize mental health care and include teletherapy options.

Getting therapy can help you clarify what kind of support you may need, whether that’s weekly sessions, medication management, or a combination of both. When you identify your needs upfront, you’ll be able to select a health insurance plan that aligns with your lifestyle and mental health goals.

Consider your budget

Every plan involves balancing premiums, deductibles, and out-of-pocket costs. A low monthly premium might seem appealing, but if you plan to attend therapy regularly, a high deductible could quickly make care unaffordable. In contrast, a slightly higher premium might come with lower copays and better mental health coverage overall.

When evaluating your budget, look at both short-term affordability and long-term value. If you anticipate ongoing therapy, the plan with more comprehensive coverage may cost less over the course of the year.

Compare plan benefits

Each health insurance plan outlines its specific benefits in a Summary of Benefits and Coverage (SBC). This document shows what’s included for physical and mental health care, such as therapy visits, psychiatric consultations, and prescription medications.

When comparing plans, look closely at the sections related to mental health services, behavioral health, or substance use treatment. Look for plans that clearly list which types of therapy are covered like Cognitive Behavioral Therapy (CBT) or family counseling and indicate that mental health care is covered to the same extent as medical care. This balance, known as parity, can help ensure you’re getting fair, comprehensive coverage. If mental health coverage seems vague or limited, that could be a red flag.

Confirm network status

Before enrolling, confirm that your preferred therapist is in-network. In-network providers have agreed-upon rates with the insurance company, meaning you’ll pay significantly less per session than if you go out-of-network. You can verify network participation by checking directly with your insurer.

Evaluate out-of-pocket costs

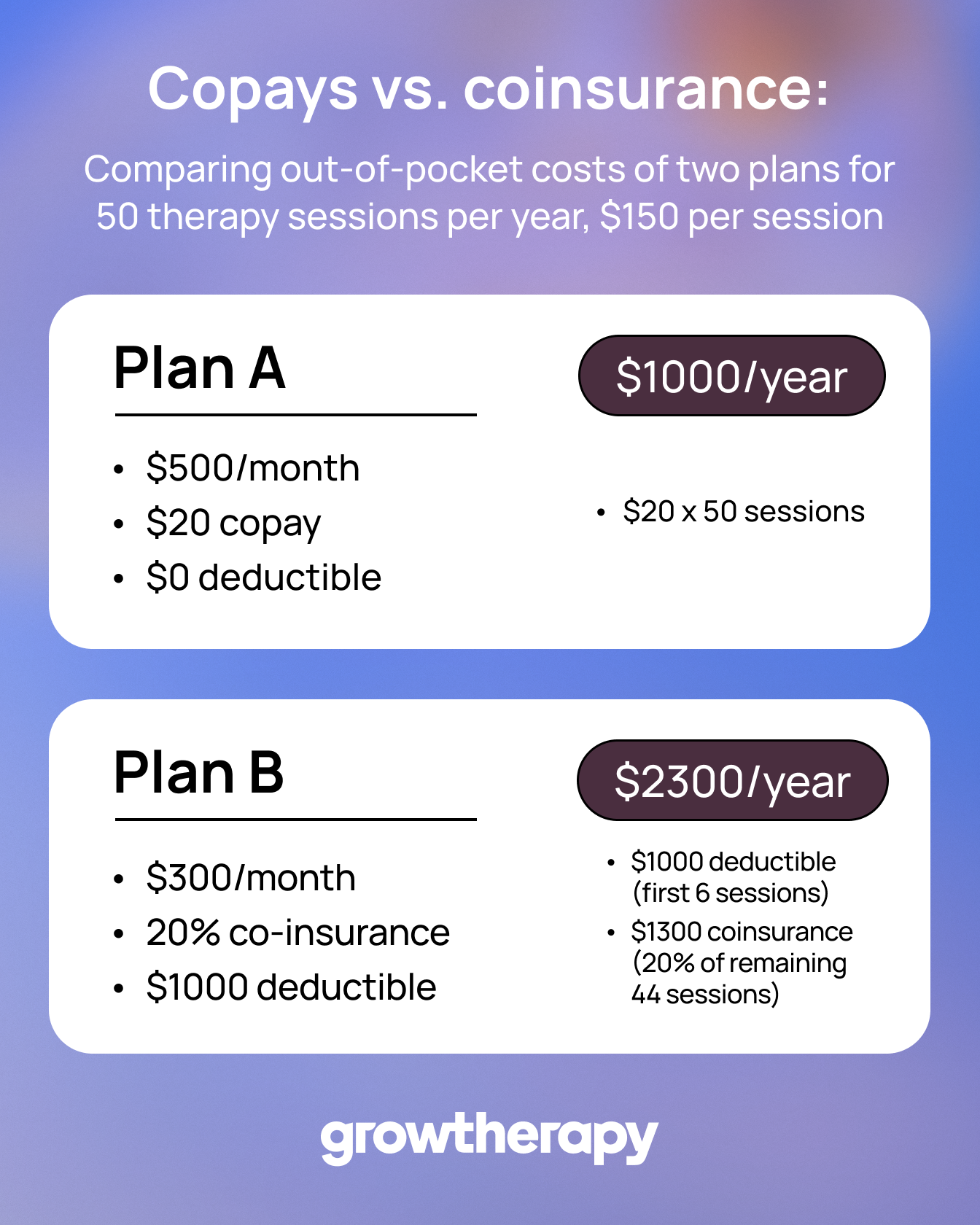

Even with insurance, you’ll likely have some out-of-pocket costs for therapy, such as copays, coinsurance, or payments toward your deductible. Review how these costs differ across plans. For example, one plan might charge a $20 copay for each therapy session, while another could require 20% coinsurance after your deductible is met.

For example, imagine you plan to attend weekly therapy sessions (about 50 per year):

- Plan A charges a $20 copay per session and has a $0 deductible. You’d pay roughly $1,000 per year for therapy.

- Plan B has 20% coinsurance after a $1,000 deductible. If each session costs $150, you’d first pay the full $1,000 to meet your deductible. After that, you’d owe 20% of each remaining session at about $30. That’s roughly $1,000 (deductible) + $1,300 (coinsurance) = $2,300 total for the year.

Even though Plan B might have a lower monthly premium, Plan A could be more cost-effective if you use therapy frequently.

When comparing plans, consider:

- Your therapy frequency: More frequent sessions can make a low-copay plan more valuable.

- Your deductible: High-deductible plans may cost more upfront, especially early in the year.

- Your total annual cost: Add therapy expenses to your annual premiums to get a full financial picture.

Understanding these differences means you’re comparing true value, not just sticker price. If you plan to see your therapist frequently, estimate your total annual cost based on the plan’s copay or coinsurance rate.

Understanding mental health coverage in insurance plans

Even though the Affordable Care Act requires most health insurance plans to cover behavioral health care, the specifics like copays, provider networks, and visit limits can vary significantly. You can avoid gaps in coverage and access therapy when you need it most by getting a clearer picture of your benefits.

Why mental health coverage matters

Even though mental health care is an essential part of overall wellness, it’s often overlooked when people select insurance. The right plan ensures consistent access to care, allowing you to manage stress, anxiety, depression, or other conditions without worrying about cost.

During open enrollment, think beyond emergency or preventive care. Your plan should make it just as easy to schedule therapy as it is to book an annual checkup. Regular mental health support can help you stay balanced at work, improve relationships, and maintain healthy routines, so this coverage is just as vital as medical benefits.

What to look for in mental health benefits

As you review plan options to find the best insurance for mental health, focus on the mental health section of the Summary of Benefits and Coverage. Look for details such as:

- Whether therapy sessions are covered for both in-person and teletherapy appointments

- If the plan specifies in-network vs. out-of-network benefits, and how those affect cost

- Whether there are session limits or caps on the number of covered visits per year

- How psychiatric medications and medication management appointments are billed

Plans that include unlimited therapy visits, cover virtual sessions, and clearly define behavioral health benefits offer the most flexibility and peace of mind.

Common pitfalls to avoid

Some health insurance plans appear affordable at first glance but come with hidden barriers to mental health care. Common issues include limited provider networks, high copays, or coverage that only includes certain therapy types. Others may require a referral from a primary care physician before you can see a therapist, adding unnecessary steps and delays.

Be cautious of plans that provide limited details about behavioral health coverage or make it hard to verify in-network therapists. Clear, transparent information helps ensure you can access consistent, affordable care. If you’re not sure how to identify these red flags, compare how each insurer lists behavioral health coverage on their website. Clear, upfront information is a good sign the company values mental health parity and accessibility.

How to verify therapist coverage

Before finalizing your choice during open enrollment, confirm that your preferred therapist or therapy platform is covered by the plan. Most insurers offer online directories where you can search for in-network providers by specialty or location. However, these directories are not always up to date.

To double-check, you can reach out to your therapist’s office directly or use the cost estimate tool to verify insurance acceptance instantly.

Final thoughts

Open enrollment is a yearly opportunity to align your health insurance plan with your mental and emotional well-being for the year ahead. The process can feel complex, but understanding what to look for gives you real control over your care.

As you evaluate options, remember that good coverage supports the whole person. The right health insurance plan should make it easy and affordable to prioritize therapy, whether through in-person sessions or telehealth appointments. If you’re unsure where to start, explore Grow’s resources on paying for therapy and getting therapy to understand your options and next steps. Understanding your coverage is one of the most empowering steps you can take for your mental health. The more informed you are, the easier it becomes to choose care that fits your life and your budget.